Learning to manage money effectively is a crucial skill for students. Developing good financial habits early can lead to a lifetime of financial stability and independence. Let us explore why saving money is important, different savings options available to students, how to cultivate smart spending habits and the importance of planning for future expenses.

Why Save Money: The Importance of Saving Regularly

Saving money is more than just setting aside cash. It’s about building a habit that will serve you well throughout your life. Here are a few reasons why saving money is essential:

- Financial Security: Having savings provides a financial cushion in case of emergencies. This security can prevent you from falling into debt.

- Achieving Goals: Whether it’s buying a new laptop or paying for course material, saving helps you reach your financial goals without relying on credit.

- Building Wealth: Regular saving, even in small amounts, can accumulate over time. The power of compound interest means your savings can grow significantly.

- Developing Discipline: Building the habit of saving teaches financial discipline and helps you prioritise long-term benefits over short-term gratification.

Different Savings Options

There are several ways students can start saving money. Here are a few options tailored to their needs:

- Savings Accounts: Opening a savings account at a bank is a safe way to store money and earn interest. Many banks offer accounts specifically designed for students with low or no minimum balance requirements.

- Piggy Banks: A traditional piggy bank can be an effective way for younger students to start saving money. It’s a simple, tangible method to understand the concept of saving.

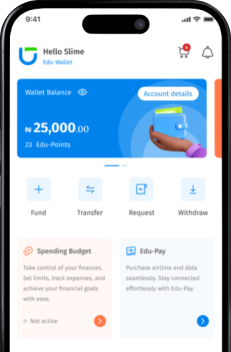

- Digital Saving Apps: Numerous apps like Facity, are designed to help students save money. Facity helps you to automate your savings and sets aside small amounts regularly.

Smart Spending Habits

Understanding the difference between needs and wants is crucial for smart spending. Here are some tips to help make informed purchasing decisions:

- Prioritise Needs Over Wants: Needs are essentials like food, transportation, and school supplies. Wants are non-essentials like dining out, entertainment and luxury items. Always prioritise your spending on needs first.

- Make a List: Before shopping, make a list of what you need to buy. This helps prevent impulse purchases and ensures you stick to your budget.

- Compare Prices: Take time to compare prices online and in stores. Look for sales, discounts and coupons to get the best deals. With the Facity app, you get to purchase goods at a discounted price from our registered vendors.

- Delay the Urge to buy Instantly: If you want to make a significant purchase, wait a few days before buying. This cooling-off period can help you decide if it’s something you really need or just an impulse buy.

Planning for Future Expenses

Saving money also means planning for future needs. Here’s why it’s important:

- Textbooks and Supplies: University textbooks and school supplies can be expensive. By setting aside money regularly, you can cover these costs without financial strain.

- Emergencies: Unexpected expenses, like medical bills, can arise at any time. Having an emergency fund helps you handle these situations without financial stress.

- Long-Term Goals: Think about future goals such as studying abroad, buying a car, or even starting a small business. Saving now can make these dreams achievable.

The money you save now will later save you!